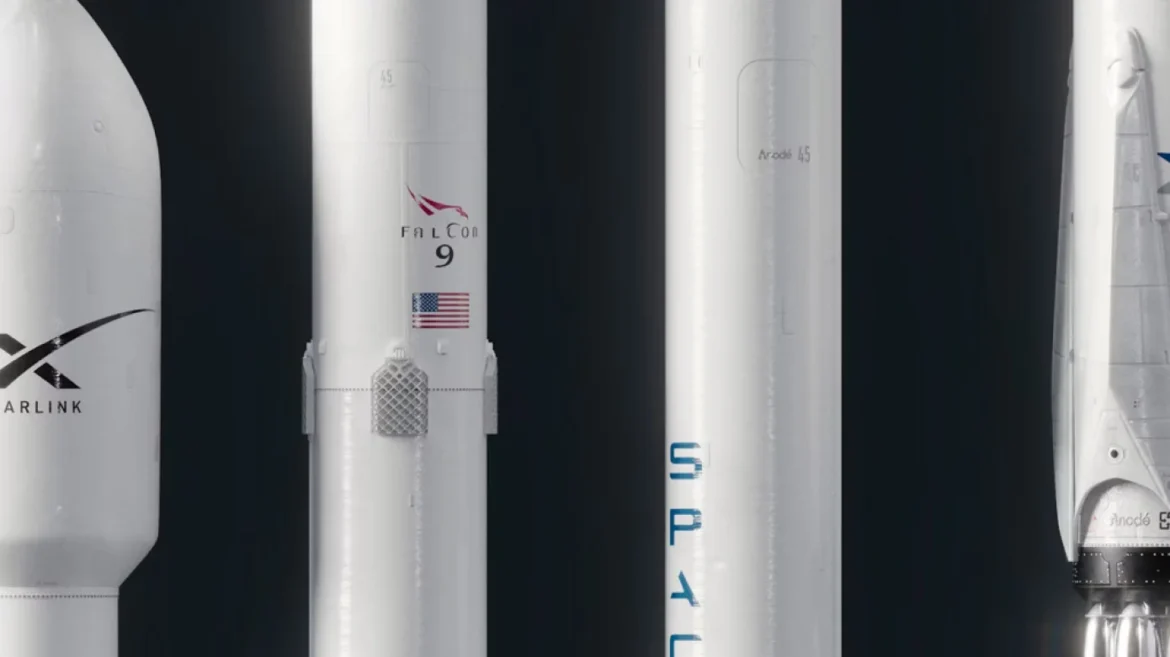

Given Tesla’s ongoing rapid stock market sell-off, Elon Musk’s large ownership in the electric car firm no longer represents his most valuable asset. Based on calculations, Elon Musk’s share in SpaceX, his private rockets and satellites company, now exceeds his ownership in Tesla for the first time in five years. Elon Musk’s net worth, at $323 billion, is the biggest in the world even with the slump.

Now valued at around $147 billion—about $20 billion more than his Tesla shares, which have suffered greatly—his SpaceX stake in Tesla’s stock price dropped by half starting in December, which helps explain Elon Musk’s asset distribution change. Among Tesla’s investors, many of whom fear about the company’s future should the declining trend continue, this has generated questions. Some experts think Tesla’s poor stock performance could be partially caused by Musk’s changing emphasis to SpaceX and other businesses. Others point to growing competitiveness in the electric vehicle (EV) market as a contributing reason, with rivals releasing competitive models meant to threaten Tesla’s supremacy.

Table of Contents

ToggleWhy Is the stock market decline of Tesla happening?

Since Donald Trump took office, Tesla has been under a lot of pressure on the stock exchange. As it becomes clear that much of Elon Musk’s focus is now on his work at the recently founded “Department of Government Efficiency,” (Doge), questions have developed. Furthermore adding uncertainty to the economy and influencing investor confidence in Tesla are the tariff policies of the new government.

While the larger market battled with the benchmark S&P 500 index finishing down 1.1%, Tesla’s shares dropped by 5.4% on Tuesday. Financial analysts estimate that hedge fund short sellers, who bet against Tesla’s stock, have made over $16 billion in paper profits by capitalizing on the company’s woes. Some observers contend that internal management problems—including supply chain interruptions and manufacturing delays—cause further difficulty for Tesla. The company’s difficulties introducing its newest car models have further sapped investor excitement.

How Is Musk Juggling Government and Corporate Responsibilities?

Elon Musk has been closely involved in federal government restructuring, leading thousands of federal workers to be laid off under a cost-cutting project. He has characterized the action as an attempt to eradicate government fraud, waste, and inefficiencies. Critics counter that these layoffs could result in gaps in vital government services, thereby having long-term harmful effects.

Host Larry Kudlow asked Elon Musk in an interview with Fox Business about the management of his companies and the concurrent administration of Doge. “Very difficult,” Elon Musk said. “I’m here simply attempting to cut waste and fraud, thereby improving government efficiency. We are making good progress thus far. Musk is still sure he can balance several high-profile duties, but some analysts think his divided attention could be hurting his political obligations as well as his commercial endeavors.

How Do Americans See Musk’s Place in Government?

The public view of Elon Musk’s new government involvement is still split. According to a recent poll, somewhat more Americans think Doge is a good concept than a terrible one. Still, the same research shows that more individuals have bad opinions of Elon Musk personally than good ones. Although some praise his audacious attempts to simplify government processes, others object to his approach because of its too forceful nature and lack of openness.

Political experts have observed that Musk’s growing participation in public policy could have long-term effects on his commercial empire. Some worry that his divisive ideas and changes might turn off possible consumers, especially those who oppose his political viewpoint. Others think his unusual approach to leadership could disturb government activities in ways yet unknown.

How Is Tesla Seeking to Increase Sales?

Recently, Tesla transported several of its cars to the White House in what seems to be a calculated action to attract interest and increase sales. As part of a campaign, the cars were arranged all across the driveway. For Tesla, this marketing campaign comes at a pivotal point since it aims to restore momentum and convince investors of its long-term survival.

As Elon Musk was looking over the vehicles, Trump complimented them and said they were “beautiful.” Sitting inside a red Tesla, he marveled, “Everything’s computer! That is very lovely. The public exhibition of Tesla cars at the White House has sparked rumors that the business might be looking for government contracts or incentives to help with running costs. Critics counter that Musk’s government involvement creates a conflict of interest and calls into doubt whether Tesla might get unfair benefits from subsidies or deals secured.

To draw in additional business, Tesla has also been using aggressive pricing policies. To make its automobiles more approachable to a wider spectrum of buyers, the business has launched discounts and unique financing choices. Notwithstanding supply chain issues, Tesla is also increasing production efforts to satisfy the rising demand for electric cars.

What Future Calls for Musk and His Companies?

The changing dynamics of Elon Musk’s riches and influence continue to alter the political and economic scene as he manages his commercial empire and governmental obligations. To rebuild investor trust and steady its stock price, analysts estimate Tesla will have to make major strategic adjustments. SpaceX is still flourishing meantime, thanks in great part to new contracts and successful missions that confirm its leadership in the aerospace sector.

Musk’s leadership is still hotly contested; admirers applaud his vision and inventiveness while detractors wonder whether his growing range of responsibilities will be taxing him excessively. The world will be watching to see how Elon Musk keeps redefining the future of technology and governance while Tesla negotiates its difficulties and SpaceX soars to new heights.